Voluntary Adoption of International Financial Reporting Standards | Case Study

| ✅ Paper Type: Free Essay | ✅ Subject: Accounting |

| ✅ Wordcount: 3273 words | ✅ Published: 23 Sep 2019 |

PROPOSAL

Title of Master Thesis

A voluntary adoption of International Financial Reporting Standards (IFRS): A case study of Small and Medium-sized Enterprises (SME’s) in Germany

TABLE OF CONTENTS

List of tables………………………………………………i

List of figures………………………………………………ii

List of Abbreviations…………………………………………iii

3.1. SMALL MEDIUM SIZED ENTERPRISES IN GERMANY

3.3. VOLUNTARY IFRS PPORTUNITIES AND LIMITATIONS

5. RESEARCH AIMS AND QUESTIONS

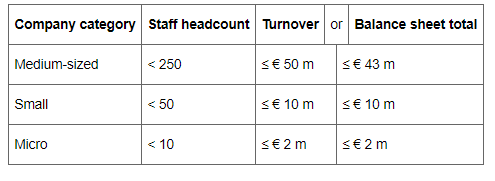

Table 1: Categorizing Companies 6

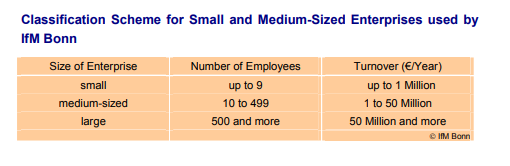

Table 2: Classification Scheme for SMEs by IfM Bonn 7

List of figures

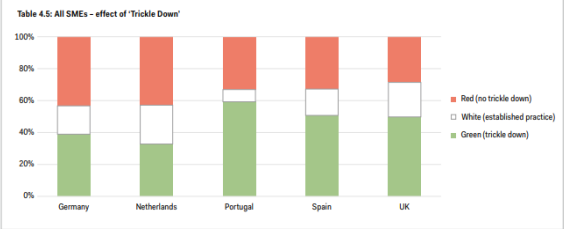

Figure 1: Summary of trickle down across all SMEs 8

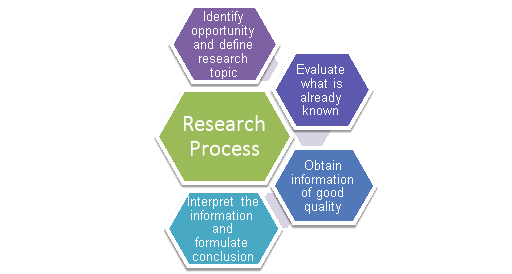

Figure 2: Research Process……………………………………………………………….10

Figure 3: Inductive vs Deductive………………………………………………………….11

List of Abbreviations

EC European Commsion

EFAA European Federation of Accountants and Auditors

EU European Union

GAAP Generally Accepted Accounting Principles

IASB International Accoutning Standard Board

IfM Institut für Mittelstandsforschung

IFRS International Financial Reporting Standards

SMEs Small and Medium-sized Enterprises

UNIDO United Nations Industrial Development Organisation

This paper aims to suggest a proposal for a study that aims to identify and evaluate evidence as to whether the accounting standard for listed businesses in Europe have influenced the accounting methods of small and medium sized enterprises. The proposal aims to suggest the prospects, opportunities and limitation of voluntary adoption of IFRS amongst small and medium sized organisations in Germany.

The International Financial Reporting Standards (IFRS) were designed by the International Accounting Standards Board (IASB) to act as a common global language between business transactions in order to provide understandable and comparable accounts across borders. The aim was to evaluate a fair value of a company’s business situation by harmonising financial reporting standards situation (Wiecek and Young, 2010). Within the context of Europe, the accounting standards of listed entities are regulated by the IFRS since 2005 onwards. Thereby the IFRS constituted a major change in the structure and representation of accounts for publically listed companies in member states. While the accounting rules for non-publicly listed companies are set by the European Accounting Derivative supplemented by the Generally Accepted Accounting Principles (GAAP) of each member state. Therefore consolidated financial statements of publicly traded organisations have to be prepared under full IFRS regulations while it is voluntary for other organisations.

Over the past decade IFRS has also influenced the accounting methods of non-public organisations in the EU. During July 2009, the IASB published the IFRS for SME after years of consultation and discussion in order to provide organisations that do not have public accountability a complete set of internationally recognised rules (Quagli and Paoloni, 2012). However, various accounting options have been simplified or omitted from the IFRS for SMEs for example the revaluation model (IAS 16, IAS 38) or the annual review of of tangible and intangibles assets is not required, as these specifications are not relevant to typical SMEs (Quagli and Paoloni, 2012).The following scenario has also given birth to the phenomenon known as the ‘Trickle Down Effect’. This concept defines the impact of IFRS trickling down in non-public organisations. Therefore the following proposal aims to identify the importance of a study that aims to analyse the opportunities and limitations of adopting IFRS for German SMEs while assessing the appropriateness of IFRS in organisations with an international orientation.

This section of the proposal aims to identify and discuss relevant literature and evidence for the proposed study. In order to provide a basis for the following discussion, this chapter will firstly discuss the importance and situation of SMEs in Germany and then evaluate the literature in regards to the application of IFRS in German SMEs.

3.1 Small Medium Sized Enterprises in Germany

This paper focuses on small and medium-sized enterprises (SMEs). Storey (1994) argues that there is no single and uniformly acceptable definition of a small sized firm as it can be measured by employees, turnover, profitability or worth. Consequently, multiple definitions of SMEs have emerged for example economic and statistical definitions provided by the Bolton (1971) or size differentiation according to customer-or product base provided by Wynarczyk et al., (1993)(Storey, 1994). As a result the European Commission pinned down the term ‘Small and Medium Enterprises and defined SMEs in terms of staff headcount and turnover or balance sheet total as demonstrated by Figure 1. Nonetheless, these limits on the figures only apply to individual firms and not groups of firms (Internal Market, Industry, Entrepreneurship and SMEs – European Commission, n.d.).

Table 1: Categorizing Companies

(Source: Internal Market, Industry, Entrepreneurship and SMEs – European Commission, n.d.).

However, the EC definition has not been embraced by all countries and constitutions for example the World Bank or UNIDO’s definition. Similarly, the Institut für Mittelstandsforschung Bonn (IfM Bonn; Institute for SME-Research Bonn, Germany) applies the following definition of classification for its SMEs. The main difference constitutes in the number of employees employed by different sized enterprises. Nonetheless, this study and proposal will comply to the EU given definition of SMEs in order to stay related and provide comparison with other empirical evidence from other member states.

Table 2: Classification Scheme for SME’s by IfM Bonn

(Source: Günterberg and Kayser, 2004)

The importance of SMEs is undeniable in stimulating economic development at national and international level (Jones and Tilley, 2003). The following can be put into perspective by identifying that there are around 23 million SMEs in the European Union providing 75 million jobs and representation 99% of all enterprises (Lang and Martin, 2017). Similarly, the German economy is strongly saturated by SMEs (Kayser and Wallau, 2002) as high numbers of family owned and owner-managed firms operate in the market. According to the European Commission 99% of 3.7 million companies in Germany can be constituted as “German Mittelstand” (KfW SME Panel, 2015). These companies employ around 15.5 million employees and contribute around 52% of the total economic output of the country. Consequently, it can be stated that SMEs are vital for the growth and prosperity of the national economy thereby they have immense importance in regards to the accounting impact derived by the rules and regulations enforced upon them. Accounting literature has identified that accounting quality has economic consequences such as cost of capital (Leuz and Verrecchia, 2000) or capital mobility (Young and Guenther, 2003).Thus, it is significant to understand the impact of accounting standards on accounting quality and thereby the impact on these organisations.

The growth of internationalisation has increased the need for international standards in order to provide transparency and comparability as argued byHopwood (1989) in his book “International Pressures for Accounting Change” that accounting can never be characterised by national aspects only. As a result all EU members including Germany have to prepare financial statements of public listed companies in accordance with (full-)IFRS and are expected to show significantly higher levels of information than non-listed companies that can prepare their statements under the German-GAAP. According to empirical evidence the adoption of IFRS in the EU has led to information quality (Ball and Brown, 1968) ; (Ely and Waymire, 1999) through positive market reactions (Armstrong et al., 2007) and higher levels of decision relevance (Landsman, Maydew and Thornock, 2009).

Nonetheless, the vast majority of non-listed enterprises are not subject to IFRS but to the regulations laid by the European Accounting Directive and to any national laws or their own GAAP. However, the trickle-down effect has influenced accounting regimes of small and medium sized enterprises. Dumontier and Raffournier (1998) researched the reasons for voluntarily adopting the IFRS for Swiss listed companies and found that factors such as internationalism, size and ownership diffusion however Raffournier (1995) did not support a positive correlation of ownership diffusion and voluntary compliance with IFRS. A more recent study of 2017 by the European Federation of Accountants and Auditors (EFAA) identified multiple reasons why the trickle down effect may consume these non-listed enterprises which included: (1) reduced complexity (2) better understanding by readers of accounts (3) comparability between entities where IFRS is allowed as a basis for tax (4)having a comparable basis for the preparation of accounts within groups, and (5) efficiency in the training of accountants (Lang and Martin, 2017). The study also found numerical evidence identifying the volume of trickle down amongst 5 major European countries which included Germany, Netherlands, Portugal, Spain and the UK as demonstrated in Figure. Consequently, it can be derived that the convergence (white plus green) of all countries evaluated in the study had at least 50per cent with Germany at 57 per cent. Thus, it clearly demonstrates that ‘trickle down’ has played a huge role in the convergence of IFRS.

Figure 1: Summary of ‘trickle down’ across all SMEs

(Source: Lang and Martin, 2017)

3.3 VOLUNTARY IFRS PPORTUNITIES AND LIMITATIONS

Various academics have identified the benefits and limitations of voluntary adoption of international financial reporting standards. However a cost-benefit analysis is vital when implying accounting standard and rationalising IFRS in SMEs. While organisations can quantify the direct costs of adopting IFRS however the total economic costs or the benefits have been hard to quantify (Gebhardt, 2000).

A major factor that supports IFRS is increased transparency and quality in comparison to national financial reporting standards as IFRS across the globe makes it easy and cost efficient for investors to compare. Kim and Shi (2012) identified that voluntary adoption of IFRS led to a 59 per cent increase in firm specific information capitalized in stock prices by providing evidence from a sample of firms from 34 countries that adopted IFRS voluntarily from 1998 to 2004. Moreover, Armstrong et al (2007) elaborated that the adoption of IFRS in Europe has led to positive market reactions and has thus provided greater levels of relevance. Gassen and Sellhorn (2006) identified that voluntary IFRS led to higher information efficiencies while Hung and Subramanyam (2004) argued better information in comparison to the German GAAP however Wang and Yu (2009) denied these findings.

Eierle and Haller (2009) surveyed German SMEs and demonstrated how size influences the perceived benefits of the IFRS and identified that a large number of their respondents did not understand the importance of IFRS as they were unable to understand the benefits of international comparability and did not have in depth knowledge of the costs and benefits of IFRS adoption. Hence it supports the statement by Quaglu and Paoloni (2012) that it is not evident that all SMEs could be interested in adopting IFRS for SMEs as their results demonstrates that German-speaking countries show lower appreciation for the standard especially the preparers of the documents. Similarly M. Kreipl et al (2004) found that non-publicly traded companies prefer the German-GAAP over the IFRS for SMEs due to multiple reasons such as general skepticicism, lack of knowledge, the convergence of German-GAAP and IFRS owing to the German Accounting Law Reform Act or in-group biases.

The current literature provides some relevant evidence regarding the situation of adoption of voluntary IFRS however; it also leaves scope for more research to complement prior studies. Most previous studies have focused on the implication of IFRS on listed firms rather than non-listed. Moreover voluntary adoption of IFRS in regard to the German economy have been ignored even though there are a few studies that touch the topic however there is space for an in-depth investigation. Thus, this proposed study aims to complement prior literature by conducting an in depth study of Germany and the prospects of voluntary adoption of IFRS.

This research aims to find valuable insights of the desire of German SMEs to adopt IFRS. The study will (1) understand the benefits of voluntary IFRS adoption (2) determine the limitations of voluntary IFRS adoption amongst German SMEs and (3) assess whether German SMEs with an international focus are more willing to adopt IFRS. In the light of this, the research shall examine why German SMEs should adopt the IFRS by addressing the following research questions:

Q1. What are the limitation of adopting IFRS in German SMEs?

Q2. What are the opportunities of adopting IFRS in German SMEs?

Q3. If unlisted firm with more international orientation are more likely to comply with IFRS

6.1 Research Method of Study

Knupfer and McLellan (1996) define research as a process of describing, explaining and validating results through a four step process elaborated by Anderson (2013) as shown in Figure 2.

Figure 2: Research Process

(Source: Anderson, 2013)

Consequently, business research aims to systematically analyse and interpret complex information (Wilson, 2014). Thus to systematically analyse the problem statement defined by this proposal this study will follow a research philosophy defined a positivism – an objective approach that allows the research to be independent of the researcher.

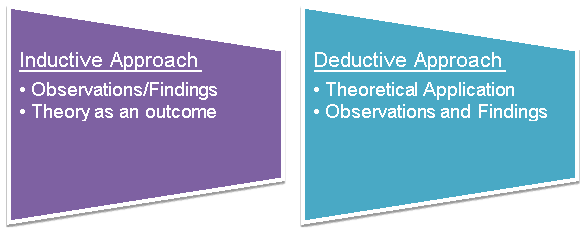

Furthermore, Figure demonstrates the difference amongst the two research approaches. in regards to the research approach the study is expected to follow a deductive approach (Bryman and Bell, 2015) which is a theory testing approach unlike the inductive approach. The study aims to analyse different given theories and data in order to find relevant observations and findings in the context of Germany.

Figure 3: Inductive vs Deductive

(Source: Wilson, 2014)

As established the research aims to focus on Germany hence the research design proposed for the study is a Case Study design. Yin (2003) defines the case study design as an inquiry that investigates a contemporary phenomenon with in a real life context. Moreover, Bell and Bryman (2015) distinguish between different types of cases based on a single organization, a single location, a person or a single event. Consequently, this study aims to present findings from a single location according to the case study design (copy pasted from thesis change wordings)

The research strategy the study is expected to follow a mixed method strategy (Bryman, 2001) which includes qualitative and quantitative data. In order to answer the rsearch questions data from various sources will be derived particularly secondary sources since primary data from non-listed organisations is hard to accumulate the study will use quantitative and qualitative information from journals, reports and official websites to answer the research questions and achieve the aim of the study effectively. Nonetheless, Wilson (2014) identifies a number of advantages of secondary data such as less-resource intensive, allows comparative analyses, can support longitudinal studies and easily accessible.

6.2 Ethical Considerations (copy pasted from thesis, all of this needs changing)

Trevino and Nelson (2016) define ethics as the principles, norms and standards of conduct governing an individual or group. Likewise, Anderson (2013) argues that ethical behaviour requires adhering to a code of conduct. While a number of ethical factors have to be taken into consideration in primary research such as approval of individual participants, approval of organisation, wellbeing of participants, informed consent, anonymity and confidentiality however since this research is only based on secondary sources hence the ethical considerations are only limited.

Consequently, it can be stated that the ethical aspect of secondary research was maintained as the ownership of external material has been acknowledged in the literature review and the data compilation. Moreover, prior to the research process ethical clearance was obtained from the university where the research is being conducted.

- Top of Form

- Bottom of Form

- Anderson, V., 2013. Research methods in human resource management: investigating a business issue. [e-book] Kogan Page Publishers.

- Armstrong, C., Barth, M., Jagolinzer, A. and Riedl, E. (2007). Market Reaction to the Adoption of IFRS in Europe. The Accounting Review, 85(1), pp.31-61.

- Ball, R. and Brown, P. (1968). An Empirical Evaluation of Accounting Income Numbers. Journal of Accounting Research, 6(2), p.159.

- Bolton, J. (1971). Small firms: Report of the Committee of Inquiry on Small Firms. London: Her Majesty’s Stationery Office, pp.13-14.

- Bryman, A. and Bell, E., 2015. Business research methods. [e-book] Oxford University Press, USA.

- Bryman, A., 2001. Social research methods. [e-journal]

- Dumontier, P. and Raffournier, B. (1998). Why Firms Comply Voluntarily with IAS: an Empirical Analysis with Swiss Data. Journal of International Financial Management and Accounting, 9(3), pp.216-245.

- Eierle, B. and Haller, A. (2009). Does Size Influence the Suitability of the IFRS for Small and Medium-Sized Entities? – Empirical Evidence from Germany. Accounting in Europe, 6(2), pp.195-230.

- Ely, K. and Waymire, G. (1999). Accounting Standard-Setting Organizations and Earnings Relevance: Longitudinal Evidence from NYSE Common Stocks, 1927-93. SSRN Electronic Journal.

- Gassen, J. and Sellhorn, T. (2006). Applying IFRS in Germany: Determinants and Consequences. SSRN Electronic Journal.

- Gebhardt, G. (2000). The Evolution of Global Standards in Accounting. Brookings-Wharton Papers on Financial Services, 2000(1), pp.341-368.

- Günterberg, B. and Kayser, G. (2004). Institut für Mittelstandsforschung Bonn: SMEs in Germany Facts and Figures 2004. [ebook] Bonn: IfM Bonn. Available at: https://www.ifm-bonn.org/uploads/tx_ifmstudies/IfM-Materialien-161_2004.pdf [Accessed 10 Jan. 2019].

- Hopwood, A. (1989). International pressures for accounting change. New York: Prentice Hall.

- Hung, M. and Subramanyam, K. (2004). Financial Statement Effects of Adopting International Accounting Standards: the Case of Germany. SSRN Electronic Journal.

- Internal Market, Industry, Entrepreneurship and SMEs – European Commission. (n.d.). What is an SME? – Internal Market, Industry, Entrepreneurship and SMEs – European Commission. [online] Available at: http://ec.europa.eu/growth/smes/business-friendly-environment/sme-definition_en [Accessed 10 Jan. 2019].

- Jones, O. and Tilley, F. (2003). Competitive advantage in SMEs. Hoboken, NJ: J. Wiley.

- Kayser, G. and Wallau, F. (2002). Industrial Family Businesses in Germany—Situation and Future. Family Business Review, 15(2), pp.111-115.

- KfW SME Panel: Growing optimism is overcoming weak investment trend. (2015). [ebook] KfW Group. Available at: https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-KfW-Mittelstandspanel/PDF-Dateien-Mittelstandspanel-(EN)/KfW-SME-Panel-2015.pdf [Accessed 10 Jan. 2019].

- Kim,J., & Shi, H (2012). IFRS reporting, firm specific information flows and institutional environments: International evidence. Review of Accounting Studies, 17(3), 474-517.doi:10.1007/s11142-012-9190-y

- Knupfer, N. N. & McLellan, H. (1996). Descriptive research methodologies. In D. H. Jonassen (Ed.), Handbook of research for educational communications and technology (pp. 1196-1212). New York: Macmillan

- Kreipl, M., Hane, T. and Mueller, S. (2014). Information Quality under IFRS, IFRS for SME and German-GAAP―Survey on Preferences of Non-Publicly Traded Mid-Sized Corporations. Open Journal of Business and Management, 02(02), pp.138-150.

- Landsman, W., Maydew, E. and Thornock, J. (2009). The information content of annual earnings announcements and mandatory adoption of IFRS. Journal of Accounting and Economics, 53(1-2), pp.34-54.

- Lang, M. and Martin, R. (2017). The Trickle Down Effect – IFRS and accounting by SMEs. [ebook] European Federation of Accountants and Auditors in SMEs. Available at: ://www.efaa.com/cms/upload/efaa_files/pdf/Publications/Articles/EFAA_Trickle_Down_WEB.pdf [Accessed 10 Jan. 2019].

- Leuz, C. and Verrecchia, R. (2000). The Economic Consequences of Increased Disclosure. [ebook] Journal of Accounting Research. Available at: http://faculty.chicagobooth.edu/christian.leuz/research/papers/economic_consequences_of_increased_disclosure.pdf [Accessed 10 Jan. 2019].

- Quagli, A. and Paoloni, P. (2012). How is the IFRS for SME accepted in the European context? An analysis of the homogeneity among European countries, users and preparers in the European commission questionnaire. Advances in Accounting, 28(1), pp.147-156.

- Raffournier, B. (1995). The determinants of voluntary financial disclosure by Swiss listed companies. European Accounting Review, 4(2), pp.261-280.

- Storey, D. (1994). Understanding the Small Business Sector. 1st ed. London: Thomson Learning, p.355.

- Wang, J., & Yu, W. (2009). The information content of stock prices, reporting incentives and accounting standards: International evidence. SSRN eLibrary.

- Wiecek, I. and Young, N. (2010). IFRS Primer. Hoboken: John Wiley & Sons, pp.p. 3-5.

- Wilson, J. (2014). Essentials of business research. Los Angeles: Sage Publications.

- Wynarczyk, P., Watson, R., Storey, D., Short, H. and Keasey, K. (1993). Managerial Labour Markets in Small and Medium-Sized Enterprises. London.

- Young, D. and Guenther, D. (2003). Financial Reporting Environments and International Capital Mobility. Journal of Accounting Research, [online] 41(3), pp.553-579. Available at: https://onlinelibrary.wiley.com/doi/abs/10.1111/1475-679X.00116 [Accessed 10 Jan. 2019].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal